Even though Support4Business is still actively involved in our core small business service offerings – bookkeeping/payroll, web design & hosting, promotional products, etc. – I really missed creating physical products. As mentioned on our About page, I have a degree in design, specifically clothing design, and though web design has some creative components, I really READ MORE

Category: Advice

Starting a Small Business in Idaho

I was recently made aware, by a friend looking to start a local business, that my blog has failed to discuss one very important topic. I have given advise on bookkeeping, marketing, organization, and many other topics to assist small businesses, but I have not addressed how to actually START a small business. So, here READ MORE

Tips for Small Business Tax Preparation

Happy New Year! I know, as a small business owner, it can be a challenge to carve out some relaxation time during all the hustle and bustle of the holidays. But, hopefully, you were able to enjoy your time with family and friends, and are ready for the new year. So, as we enter a READ MORE

Are You Ready For Online Banking?

Certainly, having a local bank is beneficial for small businesses, especially when a relationship with your local loan officer is important to solicit capital necessary for expansion. In addition, traditionally, making deposits is more convenient locally. However, with the majority of consumers using debit cards, and skipping the use of checks or cash, online banking READ MORE

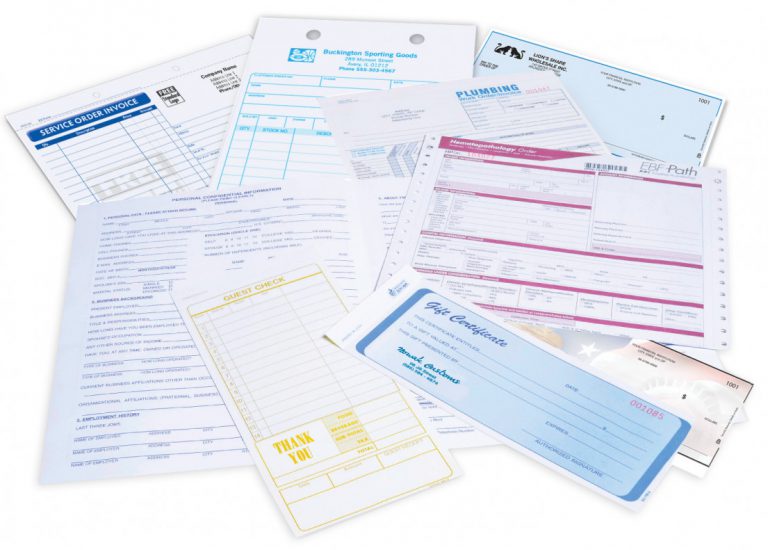

More Great Impressions With Your Business Forms

In continuation of our previous post, “Make a Great First Impression,” where we discussed the importance of professionally printed marketing pieces, in this post we will talk about making a great impression with your business’ forms and checks. We believe strongly in frugality, and we understand that it is much more affordable to use blank READ MORE